Why Are We Still Not Using DeFi?

Literacy and bad UX are holding DeFi back from entering the mainstream.

Decentralized finance or “DeFi” opens up a sea of opportunities that we never thought possible before. DeFi sets out to give everyone with internet access the power to leverage assets and earn interest from them. However, DeFi has not fulfilled the promise of its use cases. In an attempt to explain the wonders of Defi to my mom, I discovered that literacy and bad UX along with some technical problems are holding Defi back from its vision to become the hero of the unbanked and those who are left out by legacy institutions.

Before I lay out the problems, let’s unpack what is DeFi.

- Ideally, “DeFi” is transparent, decentralized, and trustless financial services.

- The idea is that there is no middle man. You will not have to go to a bank and interact with a human staff. Anyone can access financial services algorithmically. Everything is handled by a smart contract, which has an open-source code that anyone can inspect, build, and program on.

- Some well-known DeFi protocols today are Aave, Compound, Curve, PancakeSwap, Maker, and Uniswap.

Some wonderful use cases of DeFi

- Borrowing and Lending Through the power of smart contracts, DeFi lets the average person take out loans within minutes after putting up collateral as a security for the loan without any applications review or a bank account. In most cases, the percentage yield you have to pay to borrow in DeFi is much lower than what banks typically charge. Some well-known lending protocols today are Aave and Compound.

- Liquidity mining or Yield farming enables you to earn passive income on your capital. Users can earn high returns and get paid another token after depositing capital to a protocol. Examples: Compound, Curve, Balancer and Uniswap.

- Decentralized exchanges or DEXes allow you to directly swap a token for another without having to first go through a crypto-to-fiat exchange. Examples: Uniswap, Pancake swap.

5 major problems facing DeFi for the masses:

I condensed the problems I encountered at first hand and the key insights I gathered from interviewing five crypto enthusiasts and early adopters (some currently work in the industry) into 5 problems:

#1 Education and communication

These Defi lending apps or DApps are designed for people who are already familiar with crypto so there is a steep learning curve for new users. To use DApps, it’s pretty much a prerequisite that you already have some knowledge about cryptocurrency, DeFi, their purpose, and how different protocols work, knowledges that are not typically taught in schools. People need to understand Metamask, ERC20 tokens, and the concept of a seed phrase. Since there is no central server in DeFi, one may quickly come across the question: how can I reset my password if I forgot it? Baked within that is a subset of concepts like setting the gas price and canceling a transaction.

Currently, 84% of Americans are not even interested in learning what cryptocurrency is and investing in it (Source). One more alarming survey result from Cardify found that only a mere 16% of crypto investors fully understand it (Source). At the same time, while you can find many blog posts and DApps tutorials on YouTube today, these resources fail to address the wider audience. There are still too much technical jargons for the average Joe to grasp and are still not communicating to the masses in a language they understand.

#2 Bad UX

After familiarizing yourself with those concepts, you may still arrive at these lending DApps and be confused about what to do. Ok, I have my Metamask setup and my wallet connected on the DApp, now what? Looking at these lending DApps interfaces (pictured below), we can see that the interface is still too complicated for mainstream users to interact with. You are thrown into an interface with no clear and easy-to-follow instructions on how to use it. There is no explanation for the mechanism behind the high yields, the risk-reward system, and where the borrowing and lending rate come from, causing you to doubt if it’s a scam. Not to mention, each protocol works differently.

Literalllllllllyy so many steps….. before getting to this step to provide liquidity to a protocol you would have to get your funds into crypto, set up a wallet, and get your funds into Metamask or an Ethereum wallet. These steps are frictions within themselves that might turn away some users. Not to mention that you will have to sign every transaction that you will be making on these DApps.

Perhaps, developers can do a better job of holding the users’ hand through the process and show them around with an in-app onboarding tour of the features.

Navigating the space on my own with some prior knowledge of crypto and how to use Metamask, I still had to watch and rewatch Youtube tutorials that I don’t know if I can trust a hundred percent.

#3 Mitigating and managing risks

The increasing influx of capital brings more exploits, and it’s hard to regulate, for the industry is moving faster than regulation. DeFi comes with several risks that users need to be aware of such as impermanent loss, admin key risk, liquidation crises, and smart contract risks. In 2020 alone, hundreds of millions of dollars were lost due to these risks. On these DApps, there is no warning and transparency for the users about the risks involved. The interface should help inform users about the consequences of their actions. But UX alone cannot solve this problem and this again circles back to education and communication. Additionally, we will need more investment for smart contract auditing and insurance to protect users against those risks.

#4 Ethereum scalability issues

As most DApps are built on the Ethereum blockchain, Ethereum scalability issues are one the most cited friction for the mass adoption of DeFi. Every transaction on Ethereum uses gas. The high gas fees due to network congestion may turn away some participants. With the current infrastructure, the public network is also far from being able to run apps with millions of users.

#5 Interoperability

Some other immediate frictions you may face once you take that leap of faith is having your funds stuck on a chain. Each blockchain is like a “walled garden” and a separate economy; they exist in silos and cannot communicate with each other and exchange value. If these economies cannot work together, the ecosystem cannot flourish because funds cannot flow freely to generate more liquidity (Interoperability in blockchain is when two or more blockchains can communicate with each other and exchange value.) But we are not hopeless, cross-chain bridges are being built and newer platforms for building DApps like Binance Smart Chain and Polkadot are designed with interoperability in mind.

Some other note-worthy insights from my interviews:

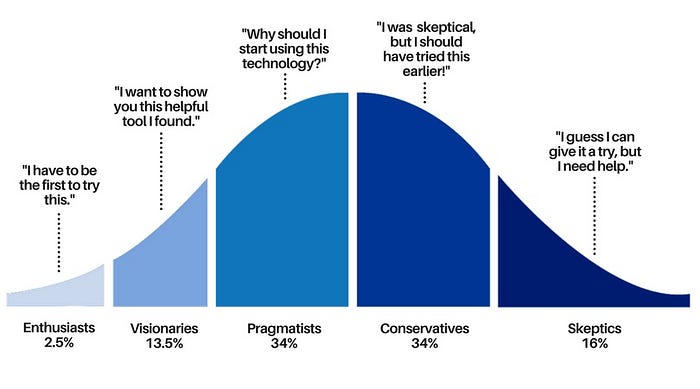

“ I think we are still barely in the majority phase of the innovation adoption curve. It usually takes conscious efforts to put products into later phases. Because of the decentralized nature of this thing, there is not an organized effort for educating people so it’s just whatever people are talking about on Twitter and Youtube. Note that there’s a barrier to these conversations, as our parent’s generation does not consume the same types and forms of media. Therefore, there’s a hump we have to get through in terms of education.”

“ You can only read so much…I think it’s people lack of attempting to give it a try.”

“The first friction is crypto itself. If people see it as a scam, they can’t even enter into the world of DeFi.”

“There’s no middle ground for normal people. It’s either stupid….where influencers are shilling you sh*t coins or way too technical.”

“Unlike Venmo or a bank, crypto is less understandable to the general public. Metamask asks you so many things when starting a wallet.”

“DeFi moves very fast, the knowledge will also need to be constantly updated.”

In a sense, this is what innovation looks like.

The problems facing DApps are similar to those facing new and upcoming technologies like Apple Watch, AR, and VR.

The first adopters of new technologies are always at an advantage to reap the most benefits before the product or service becomes mainstream. In other words, high yields come to those who farm and farm early. Currently, we are in the enthusiasts and visionaries phase, and perhaps the best way to learn is to give it a try. Maybe you will have to lose some money and learn it the hard way.

Things are getting better.

At large, DeFi is growing at a rapid speed. According to DeFi Pulse, the total value locked in DeFi is $55.18B today (at the time of writing). But even so, DeFi is still in the experimental phase. There are hurdles we have to overcome to unleash DeFi’s full potential. Without retail investors and those with minimal crypto experience, DeFi cannot disrupt banks and flourish to what developers envision it to be. Education and good user experience are the keys toward mass adoption. DApps developers and crypto nerds alike will need to help onboard the average Joe to join in on the fun.

Nevertheless, no project or innovation will ever be flawless or come without friction. For now, we can only be hopeful about what the future may bring. And maybe, one day, my mom will say to me, “I should have listened to you.”